Interim Budget Analysis and Its Impact on Real Estate Investments

Categories

Latest Post

Top Tips for Choosing the Best Property Dealers in Gurgaon

7 Key Tips to Know Before Buying Commercial Property in Gurgaon

Newly Launched Commercial Projects in Gurgaon | ADX Corp

Flipping the Narrative of Real Estate Investment Story | ADX Corp

Understanding Property Fraud Types and Prevention | ADX Corp

Newsletter

Let’s join our newsletter to get daily posts, Idea and insight.

Introduction

The introduction of the Interim Budget for 2024 has been a significant event, stirring discussions and evaluations across various sectors of the Indian economy. The real estate sector is a critical component of the country’s economic fabric. It stands to be directly influenced by the announced polilocations. This blog post aims to delve into the specifics of the Financial Plan 2024, with a particular focus on its implications for property investments.

What is Interim Budget?

In India, an interim budget is a temporary financial statement by the government. It is introduced in an election year, before a fiscal year ends. The interim budget details the government’s revenues and current expenditures. It enables the administration to maintain operations until a new government presents a full budget.

Understanding the Interim Budget 2024

The Interim Budget serves as a provisional financial statement by the government, aimed at covering its expenses until a full budget is announced. This year’s budget comes at a crucial time, as the economy seeks to balance growth aspirations with the need for sustainable development. It includes measures intended to stimulate various sectors, including infrastructure development, housing, and urban planning, which are of particular interest to investors.

Here are the main points on interim budget 2024

- Increased infrastructure spending with an allocation of ₹5.54 lakh crore, focusing on urban and rural development.

- Affordable housing boost with an allocation of ₹48,000 crore under the Pradhan Mantri Awas Yojana (PMAY).

- Allocation for the healthcare sector at ₹89,155 crore, emphasizing public health and wellness.

- Education sector receives ₹99,300 crore, focusing on skill development and digital learning.

- Defense budget increased to ₹4.78 lakh crore, ensuring national security and modernization of armed forces.

Key Highlights for Real Estate

- One of the standout features of the Interim Budget 2024 is the increased allocation for infrastructure development. A significant portion of this is earmarked for urban infrastructure, which is anticipated to boost development in these areas. Improved infrastructure not only enhances the quality of life but also increases the value of adjacent properties, making investments more attractive.

- Moreover, the budget has introduced several incentives aimed at promoting affordable housing. These include tax benefits for both developers and homebuyers, which are expected to encourage the construction of more affordable housing units. This move benefits the real estate market by addressing the housing demand. It also offers investment opportunities in a highly demanded segment.

- The government has also extended its support for the Pradhan Mantri Awas Yojana (PMAY), aiming to achieve the goal of “Housing for All by 2024.” This initiative is likely to stimulate real estate investments further, as developers leverage the scheme to build more residential projects.

- Following the financial plan, a notable uptick in demand for commercial properties is anticipated, buoyed by the infusion of funds into infrastructure projects. Capital infusion is anticipated to stimulate growth in warehousing and industrial zones. This will attract investors to promising opportunities in property development.

Impact on Real Estate Investments

The provisions in the Interim Budget 2024 have set a positive tone for real estate investments in India. The focus on infrastructure and affordable housing is expected to spur growth in the property sector, creating numerous opportunities for investors.

– Increased Infrastructure Spending: The budget’s emphasis on infrastructure development is poised to enhance connectivity and accessibility, making peripheral areas more attractive for property development. Investors might find lucrative opportunities in these emerging markets, which are likely to appreciate in value due to improved infrastructure.

– Boost to Affordable Housing: The incentives provided for affordable housing are expected to reduce the cost of development, making projects in this segment more financially viable. This could lead to an increased supply of affordable homes, meeting the urgent demand and offering attractive returns for investors.

– Enhanced Market Sentiment: The government’s commitment to real estate development and housing for all has the potential to improve market sentiment, attracting more investments into the sector. Positive investor sentiment is crucial for the growth and stability of property markets, and the interim budget’s provisions contribute significantly to this aspect.

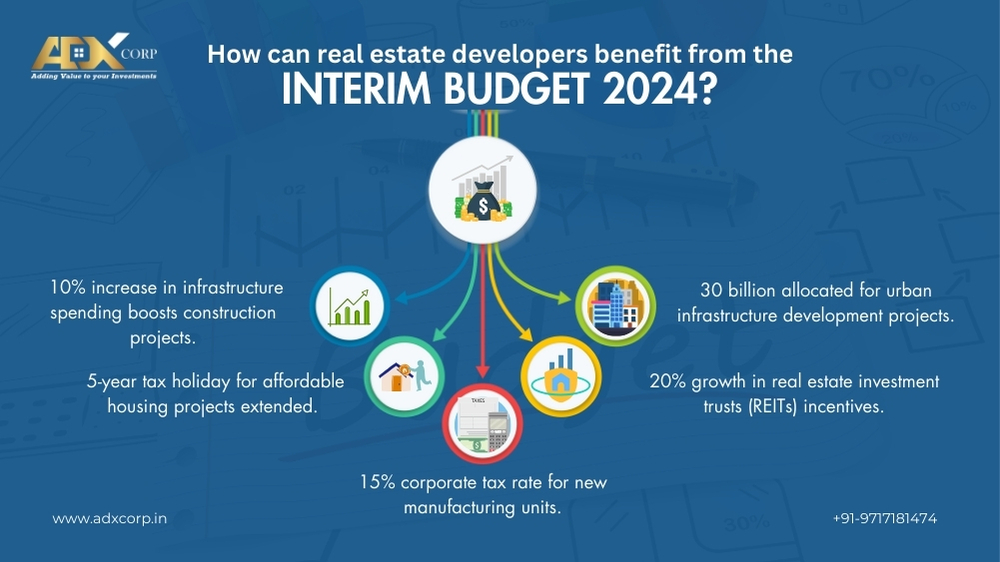

How can real estate developers benefit from the interim budget 2024?

The Interim Budget 2024 offers numerous opportunities for real estate developers. It allows them to align their strategies with government fiscal incentives and policy reforms. By leveraging tax benefits, subsidies, and eased regulatory frameworks outlined in the budget, developers can significantly reduce operational costs and enhance profitability. The budget emphasizes infrastructure development, potentially increasing demand for projects. This provides developers with opportunities to expand and explore new markets.

Challenges and Considerations

While the Interim Budget 2024 brings several positive developments for real estate investments, investors should also be mindful of potential challenges. These include regulatory hurdles, market volatility, and the impact of global economic trends on the Indian economy. It is essential for investors to conduct thorough due diligence and consider long-term trends when making investment decisions.

Conclusion

The Interim Budget 2024 presents a promising outlook for investments in India. The government has intensified its focus on infrastructure and affordable housing. This foundation could catalyze robust growth in the real estate sector. For investors, this represents a golden opportunity to explore new avenues and contribute to the country’s development goals. However, as with any investment, it is crucial to approach with caution, keeping an eye on both the opportunities and the risks that lie ahead.

Aayush Thakur

Recognized as one of Gurgaon's elite real estate consultants, Ayush Thakur has transformed the cityscape with insightful strategies, unparalleled expertise, and a keen sense of market dynamics. A trusted name in property advisory.